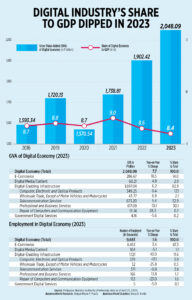

The digital economy’s annual contribution to the country’s economic output decreased as its growth slowed down in 2023, the Philippine Statistics Authority (PSA) reported on Thursday.

Preliminary data from the statistics agency showed the digital economy’s share to the country’s gross domestic product (GDP) went down to 8.4% last year from 8.6% in 2022, making it the lowest share to GDP since 2018.

In terms of gross value added, the digital sector grew by 7.7% to P2.05 trillion last year from the P1.90 trillion recorded in 2022.

However, this was slower than the 9.4% annual increase in 2022. This was the slowest expansion since the 8.7% contraction in 2020 during the pandemic.

The PSA said the digital economy is composed of digital transactions covering digital-enabling infrastructure, e-commerce, digital media/content, and government digital services.

It added the government digital services component to cover the government services directly related to supporting the digital economy.

Digital-enabling infrastructure accounted for the largest of total digital transactions last year amounting to P1.70 trillion or 82.9% of the sector’s total gross value added in 2023.

Digital media/content accounted for 2.9% or P60.21 billion in 2023. This was followed by e-commerce with a 14% contribution or P286.67 billion and government digital services with 0.2% or P4.16 billion.

In employment, there were 9.68 million employed Filipinos in the digital industries, up by 1.6% from 9.53 million in 2022. The employment growth was slower than the 8.5% in the previous year.

Last year, employment in the e-commerce sector had the largest share with 87.3% or 8.45 million employed Filipinos. Following were digital-enabling infrastructure with 11.6% or 1.12 million, digital media/content (1.1% or 104,000), and government digital services (0.1% or 5,000)

“I believe the digital industry wasn’t able to elude the long reach of inflation and sluggish business conditions that characterized 2023,” University of Asia and the Pacific Senior Economist Cid L. Terosa said in an e-mail.

Mr. Terosa said the negative sentiments in the business sector brought by the rising prices, interest rate hikes, and possible wage increase hauled the digital sector’s growth last year.

“If inflation is contained and the interest rate is lowered towards the third quarter of this year, I think the digital industry can recover but its growth trajectory will remain below what was achieved in 2022,” he added.

Inflation last year averaged 6%, higher than the 5.8% in 2022. This was also the highest in 14 years since the 8.2% average in 2008 during the global financial crisis.

The Bangko Sentral ng Pilipinas has hiked borrowing costs by 450 bps from May 2022 to October 2023, bringing the policy rate to a near 17-year high of 6.5%. — Mariedel Irish U. Catilogo