By Kyle Aristophere T. Atienza, Reporter

THE PHILIPPINES may secure as much as $100 billion in investments in the next five to 10 years as it pursues a three-way partnership with the United States and Japan, according to its envoy to Washington.

The expected investments would cover energy, semiconductors, infrastructure, and the digital economy, Philippines Ambassador to the US Jose Manuel D. Romualdez said at a briefing in Washington, based on a Palace readout.

“This may sound a little bit expanded in a way, but we are talking about a hundred billion in investments,” he said, noting that the target could be achieved even before the end of Mr. Marcos’ six-year term as the country has already liberalized some of its key sectors.

“Even five years would probably be more appropriate because of the fact that we have a lot of areas where we are putting ourselves, our economic managers are putting our country into a situation where we’re opening up our economy, especially in energy, which is very important for us,” he added.

The first-ever trilateral summit among US President Joseph R. Biden, President Ferdinand R. Marcos, Jr., and Japanese Prime Minister Fumio Kishida scheduled to take place on April 11 (US time) comes on the heels of increasing tensions in the South China Sea, which China claims almost in its entirety.

The US and Japan have been at the forefront of international condemnation of Chinese ships’ harassment of Philippine vessels deployed for resupply and rotation missions within Manila’s exclusive economic zone.

“This is the first time that we’re going to have the three countries — Japan, the Philippines, and the United States — going together to enhance economic cooperation,” Mr. Romualdez said.

The US’ gross domestic product (GDP) hit $27.36 trillion last year, while Japan’s was $4.2 trillion. The Philippines, meanwhile, is still struggling to become an upper middle-income country by 2026 with a P21.05-trillion economy last year.

The GDP of China, the Philippines’ second-largest export market and largest source of imports, hit $17.52 trillion in 2023.

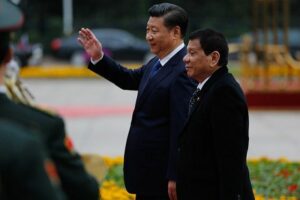

“With the Philippines’ bilateral relations with China further disintegrating as a result of real injuries in the West Philippine Sea, the previous regime’s special relationship with Beijing is all but over,” Terry L. Ridon, a public investment analyst and convenor of InfraWatchPH, said in an e-mail.

“The era of former President Rodrigo R. Duterte’s kowtow to China is over.”

Despite China’s show of force at sea, its economy is expected to slow this year. The Asian Development Bank forecasts China would expand by 4.8% in 2024, weaker than its 5.2% growth in 2023. Next year, China’s GDP growth is seen to slow to 4.5%.

FREE TRADE DEAL WITH US?

Mr. Romualdez said Manila was “seriously” considering a free trade agreement (FTA) with the US.

In April last year, US Trade Representative Ambassador Katherine Tai said an FTA with the Philippines was not on the table as the Biden government is focused on the Indo-Pacific Economic Framework (IPEF).

The Philippines and Japan are part of the US-led IPEF, which was launched a few years after the launch of the China-backed Regional Comprehensive Economic Partnership, the world’s largest FTA, of which Manila is also a member.

“There will be an economic framework, the IPEF meeting in Manila this coming May. This is probably where we are going to be given a more clear picture of where this IPEF is going,” Mr. Romualdez said.

Mr. Ridon said Philippine expectations for its investment ties with the US and Japan could be realized because the two powers have increased their presence in the country in recent years.

“Tokyo has been the nation’s most reliable development partner, with its massive development commitments in improving our railway infrastructure such as the Metro Manila Subway and the North South Commuter Railway Project,” he said.

“On the other hand, Washington has remained committed to expanding its investments in the semiconductor and IT-BPO sector, both of which have been massive drivers of year-on-year growth,” he added.

Among the US companies that Mr. Marcos is expected to have a meeting with in Washington is Seattle-based Ultra Safe Nuclear Corp., Mr. Romualdez said.

“The more exciting part of the clean energy projects that we’re trying to lure into the country is the small modular nuclear power plants.”

The envoy said a joint exploration within the Philippine exclusive economic zone in the South China Sea is also expected as Philippine companies that have been given concessions in the area have been seeking “potential partners” in the US for a joint venture in the exploration of energy sources.

Electricity costs in the Philippines are not only threatened by movements in the global energy markets but also by the expected depletion of the Southeast Asian nation’s only indigenous source of natural gas.

The Malampaya gas field, which accounts for at least 40% of electricity needs in the Philippine capital region, is projected to run dry by 2027 with expected serious repercussions for the economy.

OPPORTUNITIES

Mr. Romauldez said the Philippine energy and semiconductor sectors are expected to heavily benefit from the $100-billion investments that the Philippines is expected to gain in the coming years.

“There is an opportunity for the Philippines to attract investments, particularly from US and Japanese firms, that might leave China in the wake of the political tension in the West Philippine Sea,” Georgo N. Manzano, a trade expert at the University of Asia and the Pacific, said in an e-mail.

Mr. Manzano said the Philippines’ increasing bond with the US and Japan could significantly boost Manila’s positioning as an investment destination.

“The US is pursuing an industrial policy of ‘friendshoring’ semiconductors, digital trade, green transition industries,” he said. “These represent investment opportunities that many countries, friendly to the US, can take advantage of.”

Corazon Fabros of International Peace Bureau and Stop the War Coalition, said Japan stands “to benefit more from the trilateral arrangement, where the Philippines takes on more of the security and military aspect.”

Joseph Purugganan, convenor of Trade Justice Pilipinas and Philippine head of think tank Focus on the Global South, said the US and Japan — which are both “manufacturing giants” — needs the Philippines as a source of cheap labor and provider of raw materials.”

“In at least two main priority sectors identified — semiconductors and critical minerals — our role is located at the lower rung of the value chains, as providers of raw materials and cheap labor,” he said in a Facebook Messenger chat.

“On the partnership on critical minerals for example, this could drive further expansion of mining of these minerals, which could lead to increased environmental destruction and human rights violations.”

To maximize the target investments, the Philippines needs to improve in many facets in the ease of doing business, “from cutting red tape, improving infrastructure, to strengthening intellectual property rights,” Mr. Manzano said.