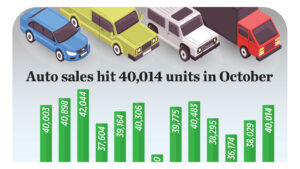

Auto sales hit 40,014 units in October – BusinessWorld Online

VEHICLE SALES hit just over 40,000 in October, as rising demand for electric vehicles (EVs) failed to offset the decline in passenger car sales, an industry report showed. Read the full story.

MORE STORIES

In this article: