RAZON-LED International Container Terminal Services, Inc. (ICTSI) posted a 26.27% rise in third-quarter attributable net income to $267.72 million, supported by higher cargo volumes and improved port revenues.

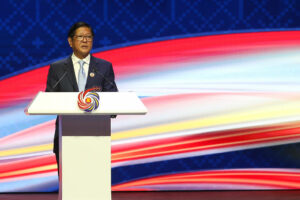

“ICTSI’s diversified portfolio has enabled us to capture opportunities in dynamic markets…,” ICTSI Chairman and President Enrique K. Razon, Jr. said in a stock exchange disclosure on Thursday.

“As we continue to invest in strategic expansions and pursue new opportunities across the Americas, Asia, and Europe, the Middle East, and Africa (EMEA), we remain committed to driving sustainable growth and innovation throughout our global network. Looking ahead, ICTSI is well-positioned to build on this momentum and deliver long-term value,” he added.

Revenues for the three months ending September climbed 19.67% to $827.74 million from $691.70 million in the same period last year, even as gross expenses rose 12.73% to $356.61 million from $316.35 million.

For the January-to-September period, ICTSI’s attributable net income increased 18.81% to $751.56 million from $632.58 million a year ago.

“ICTSI’s excellent performance in the first nine months of 2025 is a testament to the strength of our global operations and the disciplined execution of our strategy,” Mr. Razon said.

Consolidated revenues rose 16.42% to $2.34 billion from $2.01 billion in the same nine-month period last year.

Broken down by region, port operations in Asia accounted for the largest share with $985.63 million in revenues, followed by $919.70 million from the Americas and $432.46 million from EMEA.

ICTSI said its revenue growth was driven by tariff adjustments, increased volumes with a favorable container mix, and higher ancillary revenues from selected terminals.

In terms of volume, the company handled 10.69 million twenty-foot equivalent units (TEUs) in the first nine months, up 11.35% from 9.60 million TEUs in the same period last year.

Asian ports handled 5.64 million TEUs, while ports in the Americas processed 3.05 million TEUs, and those in EMEA handled 2 million TEUs.

ICTSI attributed the increase in throughput to improved trade activity across all regions. Excluding the impact of new operations in Iloilo and Indonesia, as well as discontinued operations in Indonesia, consolidated volume would still have been up by around 11%, it added.

Capital expenditure reached $449.61 million in the first nine months, mainly allocated for ongoing expansion at Contecon Manzanillo S.A. (CMSA) in Mexico, terminal upgrades in the Philippines, upfront payments for a container terminal in Indonesia, and equipment acquisitions.

The company has earmarked $580 million in capital spending for this year to fund its new project in Batangas and the third-phase expansions of its terminals in Mexico and Manila.

At the local bourse on Thursday, ICTSI shares gained P2, or 0.38%, to close at P525 apiece. — Ashley Erika O. Jose