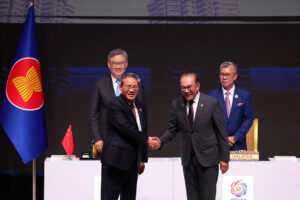

EAST WEST Banking Corp. (EastWest Bank) has launched a debit card for small and medium enterprises (SMEs) powered by Visa as it looks to expand its offerings for the segment.

The EastWest BizAccess Visa Debit card unveiled on Tuesday comes with a checking account and an online platform where SME owners can manage funds for their business.

The checking account has a minimum maintaining balance of P25,000. Meanwhile, the EasyBiz Online Business Banking platform allows business owners to view balances, monitor transactions, pay suppliers, and manage their cash flow, including processing government payments via eGov, paying corporate bills, and other transactions.

“A lot of our business banking clients are already SMEs. What this gives us right now is really a step-up in offering. With Visa’s capability, EasyBiz in terms of online, we can offer extra value-added services and offers that a small business would normally need, not only in order to start, but also to thrive… So, the real fight is really to go more into this area because they’re really the backbone of the economy at the end of the day,” EastWest Bank Chief Executive Officer Jerry G. Ngo said at a media briefing.

As of end-2023, the Philippines had about 1.2 million micro, small and medium enterprises that accounted for more than 99% of business establishments and about 66% of total employment in the country.

“We’ve already realized that a lot of our customers are already using our services for their own businesses… What we’re hoping to do is through this initiative — through this new set of products, services, and value proposition — is to formalize that,” Mr. Ngo said.

He said they want to help provide financing to SMEs that want to expand their business.

“You’ve been running your business for three to five years, but you want to scale up. At that point, you really need funds. You need capital. You need access to credit — access to the ability to scale up. And in many instances, if you haven’t kept your data clean or you’ve mixed it, it’s difficult for the bank to assess it. It’s hard to approve. And so that’s what we were trying to encourage right now, to get that conversation going, because if you need to start and to scale up, that’s the time that you really need access to the formal banking sector.”

Business owners may issue up to ten EastWest BizAccess Visa Debit cards to their staff.

It also features travel accident insurance, transaction notifications, and access to exclusive Visa promos and rewards for SME clients.

EastWest Bank is also offering welcome deals and waived over-the-counter fees for deposits and withdrawals for the card.

The online business banking platform also allows cardholders to lock and unlock their cards.

EastWest Bank’s attributable net income rose by 28.51% year on year to P2.297 billion in the second quarter, driven by its consumer segment.

This brought its first-semester profit to P4.13 billion, up by 18.51% from the same period last year.

The bank’s shares edged up by two centavos or 0.18% to close at P11.42 apiece on Wednesday. — A.M.C. Sy