By Lourdes O. Pilar, Researcher

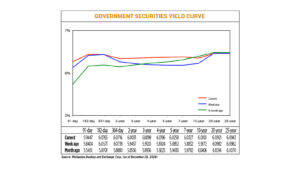

YIELDS on government securities (GS) mostly climbed last week as the market awaited the policy meetings of the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP) for hints on the future path of benchmark interest rates.

GS yields, which move opposite to prices, went up by an average of 7.08 basis points (bps) week on week at the secondary market, based on the PHP Bloomberg Valuation Service Reference Rates as of Dec. 20 published on the Philippine Dealing System’s website.

GS volume traded decreased to P24 billion last week from P35.73 billion a week prior.

At the short end, yields on the 91- and 182-day Treasury bills (T-bills) increased by 10.43 bps and 1.94 bps to 5.9447% and 6.0765%, respectively. Meanwhile, the 364-day T-bill saw its rate drop by 0.23 bp to 6.0716%.

At the belly of the curve, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rose 5.74 bps (6.0031%), 9.78 bps (6.0098%), 12.72 bps (6.0196%), 14.06 bps (6.0258%), and 14.95 bps (6.0327%), respectively.

Lastly, at the long end, the 10-year T-bond went up by 9.29 bps to fetch 6.0101%. Meanwhile, yields on the 20- and 25-year papers inched down by 0.61 bp to 6.0921% and 0.19 bp to 6.0943%, respectively.

“Local bonds had a rough week given the upward movement of US Treasuries due to data showing the resilience of the US economy and forward guidance by the Fed on future plans on monetary policy,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

The market mostly consolidated early last week as players were cautious before the policy decisions of the Fed and the BSP, she said.

“On Thursday, Philippine bonds were sold off once again after the Fed delivered a 25-bp cut accompanied by a more hawkish than expected forward guidance. Fed Chair Jerome H. Powell, in his speech after the decision, said that the Fed will be more cautious as it considers further adjustments to policy rates. The Summary of Economic Projections, which provides insights into the expectations of the FOMC (Federal Open Market Committee), showed that the members are now only expecting two 25-bp cuts for 2025 from originally four cuts,” Ms. Araullo said.

“On the other hand, the BSP also decided to cut by 25 bps. BSP Governor Eli M. Remolona, Jr. also walked back some of his comments earlier this month and said that they no longer see 100 bps worth of rate cuts in 2025, mimicking the Fed’s view. The hawkish rhetoric caused yields in the three- to 10-year space to move higher by 13 bps on average while the rest of the curve remained relatively unchanged.”

A bond trader likewise said in an e-mail that GS yields mostly rose last week following the Fed’s “hawkish cut.”

This week, both analysts expect muted trading as the market will be closed for the Christmas holidays and amid a lack of catalysts.

“Bonds will likely continue to trade at current ranges. One key risk that we are anticipating will be the release of the BTr’s (Bureau of the Treasury) borrowing schedule which may cause investors to reposition accordingly to accommodate the additional supply,” Ms. Araullo said.

“We remain constructive on short dated local bonds for now as we may see another selloff due to future macroeconomic data and supply risk.”