YIELDS on government securities (GS) ended mostly higher last week, with players focusing on the Treasury bureau’s first-quarter domestic borrowing plan amid the holidays and a lack of leads.

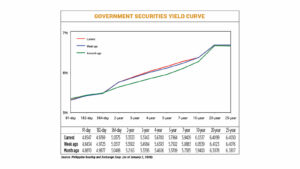

Debt yields, which move opposite to prices, went up by an average of 1.48 basis points (bps) week on week, according to PHP Bloomberg Valuation Rates data as of Jan. 2 published on the Philippine Dealing System’s website.

Philippine financial markets were closed on Dec. 30, Dec. 31, and Jan. 1 for Rizal Day and the New Year holidays.

At the short end, all tenors fetched higher yields. Rates of the 91-, 182-, and 364-day Treasury bills (T-bills) climbed by 1.13 bps (to 4.8547%), 0.44 bp (4.9769%), and 0.58 bp (5.0375%), respectively.

Bonds tenors at the belly of the curve were also quoted at higher rates across the board. Yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 0.31 bps (to 5.3533%), 1.59 bps (5.5143%), 3.07 bps (5.6700%), 4.62 bps (5.7964%), and 5.26 bps (5.9409%), respectively.

Meanwhile, at the long end, yields were down across all tenors. The 10-, 20-, and 25-year papers dropped by 0.22 bp, 0.24 bp, and 0.26 bp to fetch 6.0517%, 6.4099%, and 6.4050%, respectively.

GS volume traded last week dropped to P12.18 billion from P25.45 billion previously.

Security Bank Corp. Trust Asset Management Group Chief Investment Officer Noel S. Reyes said market players mostly took positions after the Bureau of the Treasury (BTr) released its domestic borrowing program for January to March and amid the holiday-shortened week.

“Yield movements were just influenced by mild positioning ahead of the sell-off [the prior] week after the announcement of a larger supply of bonds for 2026 pushed yields higher,” he said.

“The higher yields presented an opportunity to look for bargains, resulting in some mild buying but not enough to make a considerable impact.”

Mr. Reyes added that the domestic bond market was mostly on “holiday mode” and was largely unaffected by overseas developments due to the extended trading break.

On Dec. 23, the BTr announced that it plans to raise P324 billion from the issuance of T-bills and up to P500 billion from T-bonds in the first quarter, 88.56% more than P437-billion program for the fourth quarter.

For this year, the government plans to borrow a total of P2.682 trillion, based on the 2026 Budget of Expenditures and Sources of Financing, with 77% or P2.065 trillion coming from domestic sources and the remaining 23% or P616.86 billion from foreign creditors.

For this week, Mr. Reyes said the release of December Philippine inflation data on Jan 6 (Tuesday) will be the main trading driver.

“This week will see a reaction to the CPI (consumer price index), which is expected to remain benign but slightly higher as a result of holiday shopping,” he said.

A BusinessWorld poll of 14 analysts yielded a median estimate of 1.4% for December headline inflation, within the Bangko Sentral ng Pilipinas’ (BSP) 1.2%-2% forecast.

The BTr’s auction of reissued bonds on Tuesday could also affect yield movements, Mr. Reyes added. “We could hover around the same levels, but the bias is for lower auction yield results.”

The government is targeting to raise up to P50 billion from a dual-tenor T-bond offering, as it could borrow between P20 billion and P30 billion each in reissued seven-year papers with a remaining life of two years and seven months and via reissued 10-year debt with a remaining life of nine years and three months. — M.M.L. Castillo