The ongoing Philippines corruption scandal revolving around flood control and other projects in the Department of Public Works and Highways (DPWH) surfaced last July when prolonged habagat or southwest monsoon rains poured for over two weeks and flooded many provinces and cities in the country.

This resulted in a quick negative economic impact. GDP growth in 2025 quickly declined from 5.5% in the first two quarters (Q1-Q2) to 4% in Q3. The Bangko Sentral has projected Q4 growth of only 3.8%. If this comes true, then the Philippines’ full year growth would be 4.7%, lower than 2024’s growth of 5.7%.

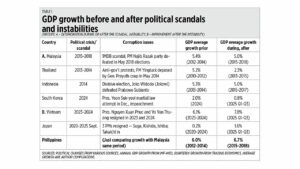

I want to estimate the Philippines’ short-term growth slowdown for 2026, and possibly 2027, based on the trends and experiences of our East Asian neighbors that also had political scandals and instability recently (see Table 1). This piece is bordering on political analysis, which is not my field, so I will limit my political commentary and focus on economic growth trends.

Malaysia experienced a three-year-long political crisis with the 1Malaysia Development Berhad (1MDB) scandal, a case of massive multi-billion dollar corruption where former Prime Minister Najib Razak was accused of channeling approximately $700 million from 1MDB into his personal bank accounts. The impact was historic — the 2018 general election ended 61 years of single-coalition rule.

Thailand experienced another military coup in 2014, and the coup leader, General Prayut Chan-o-cha, led the country for almost nine years, during which time there was a steep growth slowdown.

In 2014, Indonesia changed leadership via election and it was a highly divisive one. Its growth slowdown was mild. In 2015 President Joko Widodo faced pressure from the chairperson of his own party (PDI-P) and former President Megawati Sukarnoputri.

South Korea President Yoon Suk Yeol declared martial law in December 2024 — the second time since 1980 that martial law was imposed in the country (although, counting 2024, South Korea had been under martial law 17 times since the foundation of the republic in 1948). The 2024 martial law was very shortlived, ending after a few hours. The political backlash was severe and the growth slowdown was also severe.

Vietnam recently had internal squabbles, with two presidents resigning in the last two years.

And Japan has welcomed its very first female prime minister, Sanae Takaichi, just last October.

The numbers in Table 1 show that when instability is resolved or addressed within a year, economic recovery follows. When instability drags on for two to three years or more, an economic slowdown follows.

In the Philippines, two possible scenarios can emerge from the current situation: a.) a quick resolution of the current corruption scandal, say in 12 months (July 2025-June 2026); and, b.) a 1MDB type of scandal taking roughly three years to be resolved.

If it is (a), then it will be like Vietnam and Japan’s economic recovery from political instability, and GDP growth can recover from 2025’s possible 4.7% and rise again to around 5.7% in 2026.

If it is (b), then it will be like Malaysia’s 1MDB scandal, dragging the instability on and further pulling growth down in 2026 to around 4.5%. So far the fiscal deficit has been muted because spending has slowed down while revenues have shown improvement (see Table 2).

I hope and wish that it will be scenario (a). So the challenge now is for the mandated agencies — like the Independent Commission on Infrastructure or its successor body (to be created by legislation), the Ombudsman, and other constitutional bodies — to come up with strong proof and cases against some of the “big fish” that have been named and implicated, leading to jailtime. Then let it serve as a lesson so that corruption at this level will not occur again.

The rest of the population — both public and private sectors — should continue doing their hard productive work. Keep producing more goods and services the honest way — that will create more jobs and further industrialize the country.

Meanwhile, notice the media’s silence on the deep work behind the scenes as the new Executive Secretary monitors the various departments. Then note the fast action on red tape and corruption in audits and letters of authority from the Finance department. And the consistent Presidential communication of new projects and policy reforms.

The three high-level secretaries, plus the other secretaries and officials, are doing quick confidence-building work in the economy. These lead to renewed business confidence, governance reforms, non-wasteful spending, and non-tax increase revenue expansion and public debt reduction.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.