By Justine Irish D. Tabile, Reporter

THE CHAMBER of Automotive Manufacturers of the Philippines, Inc. (CAMPI) is eyeing a 5% growth in vehicle sales next year amid improving supply chains, introduction of new models, and public acceptance of electrified vehicles (EVs).

CAMPI President Rommel R. Gutierrez told reporters on Friday that the industry is on track to meet the 500,000 sales target for this year.

“Next year, it has to be higher… On average [we are growing] 5%… I think 5% will be a conservative figure. We will maintain (this),” he said.

If CAMPI and the Truck Manufacturers Association (TMA) achieve its 500,000 sales target this year, a 5% growth would mean vehicle sales of 525,000 in 2026.

The latest industry report showed new passenger car sales stood at 383,424 units as of the end of October, making up 76.68% of the target set for the year.

Mr. Gutierrez said sales growth will be driven by the improvement in supply, introduction of new vehicle models, and the wider adoption of EVs.

For next year, Mr. Gutierrez said he expects more sales of EVs, which is on track to account for 12% of the industry’s total sales this year.

“I think that was the target, and I think it is possible even next year, or even higher. Even the Vios model now has a hybrid, so we are moving towards that,” he said. “And I feel we see that consumers are already embracing and accepting EVs more than ever.”

In CAMPI’s report, total EV sales hit 24,265 units in the first 10 months, accounting for 6.33% of the total industry sales. However, it is important to note that some car manufacturers are not members of CAMPI and TMA, whose sales will not be reflected in the industry groups’ report.

Meanwhile, Mr. Gutierrez said car sales may also be driven by rising demand for ride-hailing services.

“Those drivers buy vehicles to use for ride-hailing services… There’s really a lot more potential… The more the players, the merrier,” he added.

Toby Allan C. Arce, head of sales trading at Globalinks Securities and Stocks, Inc., said that the 5% growth in sales is plausible and “reflects a rebound narrative that has been building over the past couple of years.”

“After several years of elevated vehicle prices, supply-chain constraints, and tighter consumer credit, the industry saw improved affordability and inventory normalization in 2025, contributing to stronger sales,” he said in a Viber message.

“If those conditions persist into 2026, a 5% uptick is reasonable — especially if consumer confidence remains stable, financing costs ease slightly alongside broader monetary easing, and manufacturers continue to introduce refreshed models that attract buyers,” he added.

Other growth drivers include urbanization, rising middle-class incomes, and infrastructure improvements, Mr. Arce said.

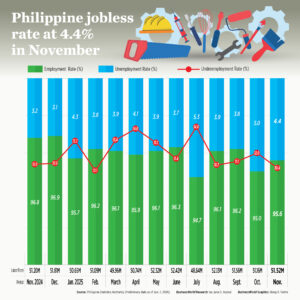

“I find CAMPI’s 5% growth outlook for 2026 credible if economic conditions remain broadly supportive — stable consumption, manageable interest rates, and steady employment will help sustain auto demand,” he said.

“However, structural hurdles such as cost of ownership, regulatory shifts, and potential macro headwinds (exchange rates, fuel prices, and credit costs) could limit upside. The industry’s performance will hinge on whether these drivers align to keep new vehicle purchases both desirable and affordable to a broad segment of Filipino consumers,” he added.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, said that CAMPI’s 5% sales forecast assumes easing interest rates and a recovery in consumer confidence.

“If rates fall and incomes stabilize, sales can grow modestly but without that, upside may be limited,” he said in a Viber message.

“Demand will likely be driven by replacement purchases, the continued expansion of ride-hailing and logistics fleets, improved availability of models, and growing interest in hybrid and entry-level vehicles,” he added.

However, Mr. Rivera said that the industry will continue to be challenged by high borrowing costs, the peso weakness which raises vehicle prices, and cautious household spending.

For next year, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that reduction in borrowing costs as a result of recent rate cuts would help increase demand for vehicles.

He said that the Bangko Sentral ng Pilipinas’ recent cuts, which brought the key policy rate to a three-year low of 4.5%, coupled with the reduction in banks’ reserve requirement ratio, have increased the loanable funds of banks.

“These are passed also in terms of lower vehicle loan rates, which would help increase demand for vehicles, especially those financed by loans,” Mr. Ricafort said in a Viber message.

“Better weather conditions towards the end of 2025 and into 2026, especially into the Christmas holiday spending season, would help fundamentally support increased demand for vehicles, alongside increased demand for EVs amid increased competition that helped reduce prices and increased options for Filipino buyers,” he added.

Meanwhile, CAMPI signed a memorandum of understanding with the Intellectual Property Office of the Philippines (IPOPHL) to go after counterfeit auto products sold online.

“We hope this will be a deterrent for those wanting to sell fake parts online. It is really for the protection of our consumers,” said Mr. Gutierrez.

The partnership will allow CAMPI members to flag counterfeit products and have the listings taken down from the online platforms.

IPOPHL data showed that two out of the 44 counterfeit-related reports it received this year involved vehicle products, including fake oils and motorcycle parts.

Last year, the agency received four vehicle-related reports involving oil, coolants, and components for the Japanese car brand Honda.