HONG KONG — Metro Pacific Investments Corp. (MPIC) has started evaluating the potential acquisition of Villar-led PrimeWater Infrastructure Corp., as it reviews the company’s operations and financials.

“We signed the NDA (non-disclosure agreement) with them. They have opened up the data room to us. We are getting initial feedback from the preliminary analysis on the numbers they have provided us,” MPIC Chairman, President, and Chief Executive Officer Manuel V. Pangilinan said during the company’s briefing in Hong Kong on Thursday.

Mr. Pangilinan said the company is still conducting first-stage analysis and will likely need another week to frame an offer.

“Nothing is finalized yet. We are at the beginning of the process,” he added.

MPIC is taking a cautious approach, considering how to structure a potential acquisition, he noted. “I think they have about 70 to 80 properties all over the Philippines, and some are small, some are big. We do not know the approach yet, whether we will bid for only certain of the properties that are large enough to give us profitability, or whether they will insist that we acquire the entire thing.”

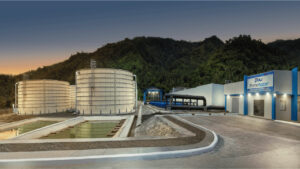

MPIC already has a significant presence in the water sector through Metro Pacific Water (MPW), its water infrastructure investment arm, and Maynilad Water Services, Inc., which serves the West Zone of Metro Manila under a government concession.

PrimeWater, a subsidiary of Prime Asset Ventures, Inc., serves over 1.7 million households and supplies about 500 million liters of water per day across more than 100 partnered water districts nationwide. Its operations span multiple provinces, including Bulacan, Batangas, and Laguna. The company is owned by Manuel Paolo A. Villar, the eldest of the Villar siblings.

On PrimeWater’s debt level, Mr. Pangilinan said no valuations have been discussed yet. “We haven’t discussed how to deal with those debts, so no valuations have been indicated by us to them. We are looking, and I think if it works for us, if it’s commercially feasible, then obviously we will take a look at it more seriously,” he said.

Sought for comment, China Bank Capital Corp. Managing Director Juan Paolo E. Colet said the acquisition could turn out to be a profitable water services business for MPIC. “Depending on the final numbers and terms… just like what they did for Maynilad, they could turn this into a successful investment,” he said.

President Ferdinand R. Marcos, Jr. earlier directed the Local Water Utilities Administration, which supervises more than 500 water districts nationwide, to investigate consumer complaints against PrimeWater. The probe covers the company’s 73 joint venture agreements with local water districts.

MPIC is one of the three key Philippine units of Hong Kong-based First Pacific Co. Ltd., along with Philex Mining Corp. and PLDT Inc. Hastings Holdings, Inc., a unit of PLDT Beneficial Trust Fund subsidiary Medi-aQuest Holdings, Inc., holds a majority stake in BusinessWorld through the Philippine Star Group, which it controls. — Ashley Erika O. Jose