Big events were happening in Kuala Lumpur at the ASEAN Summit, which opened on Oct. 26 and ends today, the 28th. Last Sunday saw the 47th ASEAN Summit and President Ferdinand R. Marcos, Jr. attended. Then came the ASEAN-US Summit with US President Donald Trump, and the ASEAN-Japan Summit with Japan’s new prime minister, Sanae Takaichi.

The 28th ASEAN Plus Three (with China, Japan, and South Korea) Summit was held yesterday, then the 20th East Asia Summit, the ASEAN plus India, Australia, New Zealand, the US, and Russia. Brazil and South Africa attended as observers. Today will see the handing over ceremony of the ASEAN Chairmanship from Malaysia to the Philippines, to begin on Jan. 1, 2026.

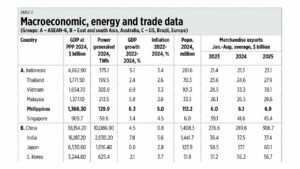

In honor of the ASEAN Summit, I gathered some basic economic data about the major economies of ASEAN — six countries out of the 11 members — then their major trade partners in the region, America, and Europe.

In GDP size at purchasing power parity (PPP) values, the top five are China, the US, India, Russia, and Japan. When it comes to power generation in terawatt hours (TWh), the same countries are in the top five.

Looking at the GDP growth average for 2022-2024, the top three fastest growing countries were India, Vietnam, and the Philippines. The slowest were Germany, Japan, and France. When it comes to inflation rate, the highest are Russia, the UK, and Brazil; the lowest are China, Taiwan, Thailand, and Malaysia.

In merchandise exports, despite Trump’s tariff hikes which kicked off in April, all of East Asia have actually experienced expansion in exports; India’s exports were flat, and Australia’s are declining, as are the US’ and Europe’s (see Table 1).

We should focus on industrialization, investment, trade expansion, and economic prosperity, not war mongering. The ASEAN is a good venue for this long-term goal.

THE STATE OF OUR CASHLast week, the Bureau of the Treasury (BTr) released the cash operations report and fiscal condition for September this year. Here I compare the totals for January-September of the last four years.

The budget deficit by end-2025 may exceed the programmed P1.6 trillion as it was already P1.1 trillion by September (see Table 2).

The allotment to local government units (LGUs) via the National Tax Allotment (NTA) keeps rising, from P871.4 billion in 2024, the programmed P1.03 trillion in 2025, and P1.19 trillion in 2026. The Department of Finance (DoF) has targeted that LGUs would fund services in health, education, agriculture and environment, roads and infrastructure, technology, and security and social protection (HEARTS).

DoF secretary and LANDBANK Chairman Ralph G. Recto also delivered cash assistance, particularly to the earthquake-damaged provinces of Cebu and Davao Oriental. In addition, he unveiled higher tax-free benefits for Filipino workers nationwide, including higher tax-exempt monetized unused vacation leave credits for private employees from 10 to 12 days. Good move there, Secretary Recto.

Yesterday I attended the 2025 Fiscal Policy Conference organized by the Department of Budget and Management (DBM), held at the UP College of Law. The plenary speakers in the morning included University of the Philippines (UP) National College of Public Administration and Governance (NCPAG) Professor Emeritus Alex Brillantes, UP School of Economics Professor Emeritus Winnie Monsod, University of Asia and Pacific Professor Emeritus Jess Estanislao, and Jose Syquia of the Asian Development Bank. The plenary discussion was moderated by DBM Undersecretary Margaux Salcedo. The Keynote Address before lunch was given by DBM Secretary Amenah F. Pangandaman.

The afternoon panel speakers included DoF Undersecretary Renato Reside, Jr., Department of Economy, Planning, and Development Undersecretary Joseph “Dockoy” Capuno, academics from Ateneo, De La Salle, UP NCPAG, other government agencies like the Bangko Sentral ng Pilipinas and Congressional Policy and Budget Research Department.

From the abstract of the paper “Select Application of Data Science in Public Finance: The Case of the Philippines,” by Reside, Ortillan, and Bonico, they focused on two important DoF operations — forecasting of flows of public revenues (including taxes and customs duties), and explaining local tax effort ratios across the country.

From the abstract of the paper “Catching them at first light: Predictors of project restructuring in the Investment Coordination Committee” by Capuno, Cambel, and Gonzalvo, they wanted to identify via regression methods projects that are likely to be delayed and restructured causing higher costs.

Public fora like this are important, help engage the public (especially the economics and public finance researchers) to find ways to control the rising public debt and rising interest payment that add pressure for the avoidance of tax cuts, if not future tax hikes.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.