YIELDS on government securities (GS) went down last week amid the growing likelihood of a rate cut by the US Federal Reserve this week due to soft inflation data.

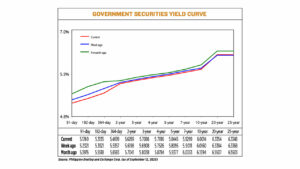

GS yields, which move opposite to prices, declined by an average of 4.21 basis points (bps) week on week at the secondary market, according to data from the PHP Bloomberg Valuation System Reference Rates as of Sept. 12 published on the Philippine Dealing System’s website.

At the short end, the 91-, 182-, and 364-day Treasury bills (T-bill) fell by 8.73 bps, 9.92 bps and 11.68 bps to fetch 5.0896%, 5.2143% and 5.3531%, respectively.

At the belly, rates of the two-, three-, four-, five- and seven-year Treasury bonds (T-bonds) also declined by 2.92 bps (5.5977%), 2.84 bps (5.6802%), 2.87 bps (5.7529%), 3.14 bps (5.8131%), and 3.88 bps (5.8911%), respectively.

Meanwhile, rates at the long end were mixed, with the 10-year T-bonds falling by 3.12 bps week on week to 5.9702, while yields on the 20- and 25-year debt rose by 1.39 bps and 1.43 bps to 6.3493% and 6.3491%, respectively.

GS volume traded fell to P46.9 billion on Friday from P63.87 billion the week prior.

“Yields broadly declined over the week amid growing expectations of a September rate cut from the US Federal Reserve following the soft US producer and consumer inflation reports,” the first bond trader said in a Viber message.

US consumer prices increased by the most in seven months in August amid higher costs for housing and food, but a surge in first-time applications for jobless benefits kept the Federal Reserve on track to cut interest rates next Wednesday, Reuters reported.

The larger-than-expected rise in the consumer price index (CPI) reported by the Labor department on Thursday resulted in the biggest year-on-year increase in inflation since January. Higher inflation and softening labor market conditions fanned fears of stagflation, and pose a dilemma for the US central bank, beyond Wednesday’s anticipated rate decision.

The CPI rose 0.4% last month, the biggest gain since January, after increasing 0.2% in July, the Labor department’s Bureau of Labor Statistics said. The CPI was driven by a 0.4% jump in the cost of shelter. Food prices increased 0.5%, with prices at the supermarket soaring 0.6%.

In the 12 months through August, the CPI advanced 2.9%, the largest increase since January, after climbing 2.7% in July.

Economists polled by Reuters had forecast consumer prices would rise 0.3% in August and increase 2.9% on a year-over-year basis.

Financial markets have fully priced in a quarter-percentage-point reduction in rates this Wednesday, with the Fed expected to deliver two similar-sized additional cuts this year.

Meanwhile, another cut by the Bangko Sentral ng Pilipinas this year also remains possible as inflation remained below the central bank’s 2-4% target even as it picked up to 1.5% in August from 0.9% in July, the first trader added.

“Despite prospects of further rate cuts, increasing demand from investors securing fixed returns also contributed to the decline in government bonds.”

A second bond trader said GS yields mostly moved sideways as players were likely taking positions before the Fed’s Sept. 16-17 meeting.

“Two-way interest was seen as some investors try to take profit ahead of quarter-end while some are just waiting to reposition at key levels,” the second trader said.

For this week, yields may continue to go down as the market awaits the Fed’s policy meeting, the first trader said.

“Local yields might continue to decline… as market participants will likely seek for clues on the future moves of the Fed based on potential policy hints from Fed Chair [Jerome H.] Powell following the expected rate cut by the US central bank this week,” the first trader said.

“We now look forward to the language in this week’s FOMC (Federal Open Market Committee) decision for more clues,” the second trader added. — Lourdes O. Pilar with Reuters