Britain’s small and medium-sized enterprises are falling behind on climate commitments, with just one in eight classed as “net zero ready” as tougher sustainability reporting rules approach.

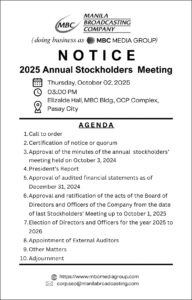

According to Aldermore’s latest Green SME Index, progress towards decarbonisation has stalled among small businesses despite looming deadlines and potential financial gains. From 2026, some firms will be required to comply with new UK Sustainability Reporting Standards, which are expected to align closely with international climate disclosure rules.

Yet only 13 per cent of SMEs have so far put in place the formal measurements and commitments needed to cut emissions to net zero by 2050. The figure has not improved since Aldermore’s last survey in 2024, prompting concern about a growing “net zero divide” between more proactive companies and those yet to take any action.

The research found that while a quarter of SME leaders (24 per cent) are still assessing their environmental goals, more than three-quarters remain at an early stage or are actively disengaged.

A lack of knowledge appears to be a major barrier: two-thirds of respondents said they had never heard of Scope 1, 2 or 3 emissions – the internationally recognised categories that underpin greenhouse gas reporting requirements.

Meanwhile, 82 per cent of SMEs said sustainability demands felt like a barrier rather than an opportunity for their business.

Despite such concerns, the findings also point to significant upside potential. SMEs estimated they could generate an additional £52,000 in income each year by improving their sustainability credentials. However, on average they had spent only £5,500 exploring greener practices and just under £24,000 implementing them.

Lauren Pamma, head of energy and infrastructure at Aldermore, said many smaller firms had the ambition to decarbonise but lacked the resources or expertise to do so.

“Our research shows genuine ambition among SMEs to decarbonise, but a lack of knowledge, resource and access to capital is holding many back,” she said. “With reporting deadlines approaching, now is the time for government, industry and finance partners to step up their support. By closing the skills gap and providing targeted funding, we can help SMEs unlock the substantial growth, energy security and cost-savings that sustainability delivers.”

Aldermore highlighted its own efforts to support the transition, including a £25 million funding package for Osprey Charging Network, one of the UK’s fastest-growing electric vehicle charging operators.

But with 5.5 million SMEs accounting for 99 per cent of British businesses, industry leaders warn that without broader action, the UK risks missing its climate targets while small firms lose out on efficiency savings and growth opportunities.