RAZON-LED International Container Terminal Services, Inc. (ICTSI), through its unit, has raised its stake in Inhaúma Fundo De Investimento Imobiliário – FII (FII Inhaúma), which holds the perpetual rights to a terminal it plans to develop.

In a stock exchange disclosure on Wednesday, ICTSI, through its wholly owned subsidiary ICTSI Americas BV, said it acquired an additional 26% interest in FII Inhaúma, raising its total ownership to 73%.

The company said the property will support the expansion and ongoing operations of ICTSI Rio Brazil, and may also be used for future activities.

ICTSI also said it has obtained and secured all necessary regulatory approvals for the transaction, noting that the total consideration is less than 10% of its total consolidated shareholders’ equity as of December 2024.

In April, ICTSI said it was set to expand its operations and capacity in Brazil after acquiring a 47% interest in FII Inhaúma.

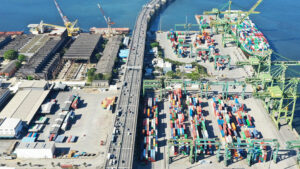

ICTSI said FII Inhaúma’s property is adjacent to its Rio Brazil terminal. The site spans approximately 32 hectares of an inactive shipyard, which will be used by the port operator to expand its capacity for existing operations.

Established in 1987, ICTSI operates 33 terminals in 20 countries across six continents.

For this year, ICTSI has allocated approximately $580 million in capital expenditures, primarily for the development of the Southern Luzon Gateway in the Philippines, as well as for planned expansions at ICTSI Rio in Brazil and at the Mindanao Container Terminal (MCT).

The Razon-led port operator said this year’s capital expenditures will also fund the ongoing expansion of the Matadi Gateway Terminal (MGT) in the Democratic Republic of the Congo, the Phase 3B expansion at Contecon Manzanillo (CMSA) in Mexico, and the acquisition and upgrading of equipment.

ICTSI reported a 14.1% year-on-year increase in its first-quarter net income attributable to equity holders to $239.54 million, supported by higher port revenues and growth in consolidated volume.

At the local bourse on Wednesday, shares in the company rose by P30.60, or 6.91%, to close at P473.60 apiece. — Ashley Erika O. Jose