PHILIPPINE SHARES snapped their three-day climb on Thursday as the main index fell to the 6,400 level anew after the United States announced that it plans to impose a 20% “reciprocal” tariff on imports of Philippine goods starting Aug. 1.

The Philippine Stock Exchange index (PSEi) dropped by 0.63% or 41.14 points to close at 6,463.20, while the broader all shares index went down by 0.13% or 5.16 points to 3,812.46.

“The market is toppish because it’s above the 6,500 level and so profit taking is understandable, using as an excuse to sell the news on higher 20% tariff rate slapped on the Philippines by the US,” First Metro Investment Corp. Head of Research Cristina S. Ulang said in a Viber message. The PSEi closed at the 6,500 level for the first time in nearly two months on Wednesday.

“The local market’s sideways movement ended in the negative territory, reflecting investors’ reaction towards the US’ upward revision of its tariffs on Philippine exports from 17% to 20% effective on Aug. 1,” Philstocks Financial Inc. Research Manager Japhet Louis O. Tantiangco said in a Viber message.

The Philippines is concerned about the United States’ decision to impose 20% tariffs on Philippine exports but will continue to negotiate, its economic affairs minister said on Thursday, Reuters reported.

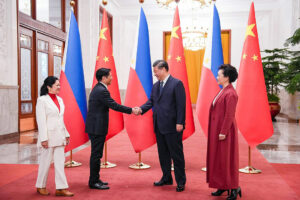

Secretary Frederick D. Go, the special assistant to the President for investment and economic affairs, told reporters that the Philippines remains committed to talking with the United States in pursuit of a bilateral deal, such as a free trade agreement (FTA).

“We remain committed to continuing negotiations with the US in good faith to pursue a bilateral, comprehensive, economic agreement, or if possible an FTA,” Mr. Go told a media briefing.

Philippine officials are scheduled to travel next week for talks with their US counterparts before the tariff rate takes effect on Aug. 1.

Majority of sectoral indices closed lower on Thursday. Financials went down by 1.1% or 24.83 points to 2,223.71; industrials dropped by 0.79% or 73.45 points to 9,142.09; holding firms sank by 0.75% or 42.84 points to 5,648.7; and property retreated by 0.3% or 7.60 points to 2,472.65.

Meanwhile, mining and oil increased by 2.42% or 222.92 points to 9,417.70 and services rose by 1.17% or 25.68 points to 2,209.57.

“Monde Nissin Corp. was the top index gainer for the day, climbing 3.89% to P7.75. Ayala Land, Inc. was the worst index performer, dropping 3.36% to P27.35,” Mr. Tantiangco said.

Value turnover climbed to P9.45 billion on Thursday with 1.40 billion shares traded from the P7.79 billion with 1.41 billion issues exchanged on Wednesday.

Advancers bested decliners, 107 versus 85, while 55 names were unchanged.

Net foreign selling climbed to P580.67 million on Thursday from P220.66 million on Wednesday. — Revin Mikhael D. Ochave with Reuters