Last week, on June 26, the Energy Institute (UK) released its annual Statistical Review of World Energy (SRWE) 2025. This has been among my favorite databases and sources of Excel files for many years.

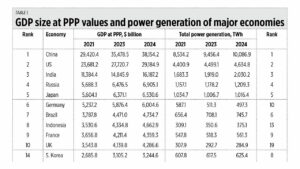

So, I start by comparing the power generation of major economies with large gross domestic product (GDP) size at purchasing power parity (PPP) values, which comes from the IMF World Economic Outlook (WEO) 2025 database.

The top five largest economies in the world in GDP size in 2024 were also the top five in power generation. In GDP size, China is 1.3 times larger than the US, 5.8 times larger than Japan, 6.4 times larger than Germany, 8.9 times larger than the UK, and 27.9 larger than the Philippines.

China’s electricity production in 2024 was two times larger than the US, 10 times larger than Japan, 20 times larger than Germany, 35 times larger than the UK, and 78 times larger than the Philippines. One way to look at it is that our total power generation in one year is equivalent to only five days generation in China. Notice also the declining trend in power generation of Japan, Germany, and the UK (see Table 1).

This is clear proof that energy is development. A bigger energy supply sustains more economic activities and business expansion. That is why our main goal in energy policies should be the continued expansion of power generation, regardless of where the power comes from — thermal or renewable, fossil fuels or intermittent sources.

From 2017 to 2023, the average increase in Philippine power generation was 4,200 gigawatt-hours (GWh) a year while Vietnam’s was 13,650 GWh a year. But from 2023 to 2024, the Philippines increased its power generation by 10,000 GWh while Vietnam grew by 27,000 GWh. This is the highest increase in a year that the Philippines has attained, and it largely explains why the Philippines’ GDP size has jumped from an average of $70 billion a year from 2017 to 2023 to $104 billion from 2023 to 2024. We need to keep expanding our power generation plus the necessary modernization in power transmission, distribution, and supply infrastructure.

Along with this policy and the passage of the PhilAtom bill in both Houses of Congress, I saw one good report the other day: “CSP could be waived for first nuclear project” (BusinessWorld, June 29).

There are many countries in the world that continue to use nuclear energy for the production of electricity, along with industrial, agricultural, and healthcare applications. Four of the top 10 nations when it comes to nuclear generation are Asian nations.

While Germany shut down all its nuclear plants in 2024 and Taiwan did the same this year, other countries are ramping up their nuclear generation led by China, South Korea, India, Japan, and the United Arab Emirates (UAE). The latter has had the most surprising expansion of its nuclear power capability, from none at all until 2019 to 40,600 GWh in 2024 (see Table 2).

Countries whose power mix in 2024 included at least 10,000 GWh from nuclear energy were Argentina, Brazil, Mexico, Belarus, Bulgaria, Hungary, Romania, and Slovakia. Other countries whose power mix included less than 8,000 GWh from nuclear generation in 2024 were Iran, the Netherlands, Slovenia, and South Africa.

Denuclearized and decarbonizing Germany has had a GDP performance of between -0.3% and zero over the past eight quarters (Q2 2023 to Q1 2025). Their expensive electricity — relying mainly on intermittent solar-wind plus costly battery — contributed to the trend towards degrowth and deindustrialization.

The Philippines’ shortest route to going nuclear is to refurbish and revive the Bataan Nuclear Power Plant — which can potentially produce 620 megawatts (MW) — and start its operation within four years. Otherwise, build new conventional nuclear plants of 600-1,200 MW. It would be better if both were done.

Meralco is the energy company that is most prepared to go nuclear. They have already sent Filipino scholars to study graduate-level nuclear engineering in at least five countries — the US, China, France, South Korea, and Japan, I think. Aboitiz Power has expressed early interest in going nuclear while San Miguel Global Power and Prime Energy, I think, have their own plans to go nuclear.

This could mean an abundant energy supply, stable and reliable running 24/7 at competitive prices even without taxpayers’ subsidy. We should go for this to help sustain our high GDP growth trajectory.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.