By Luisa Maria Jacinta C. Jocson, Reporter

MICHAEL JOSEPH D. SERVER, a 28-year-old Filipino entrepreneur, has been renting a condominium unit in Quezon City near the Philippine capital for two years now and doesn’t plan to buy his own house soon.

“Owning a home is one of the biggest financial decisions you can make,” he told BusinessWorld. “Outside of saving for a downpayment, there are a number of factors I’d need to take into consideration before making a concrete decision.”

A study by PhilhealthCare, Inc. (PhilCare), a health maintenance organization, found that 39% of Generation Z (Gen Z) people — those born in the late 1990s to early 2000s — cited homeownership as one of their top worries.

“For a young working professional, it can be challenging to acquire a property right away, especially with the rising prices,” Roy Amado L. Golez, Jr., director of research and consultancy at Leechiu Property Consultants, said in an e-mailed reply to questions.

“If their only source of income is their salary, they need to set aside enough funds for a downpayment and make sure they’re able to sustain installment payments,” he added.

Buying a house today has changed drastically from just a few decades earlier.

“Housing availability was already a major issue even decades ago,” Mr. Golez said. “There were not enough homes for the general population, and this caused terrible traffic even then.”

“During the time of our parents, buying a home in Metro Manila meant buying a house and lot or townhouse with a lot of space. Land prices in general were still affordable relative to household income,” he pointed out.

Alyssa C. Uy, an account director and freelancer, owns a condo unit where she lives in some days, but for the most part, she still lives in her parents’ house.

“Given the current market and landscape for homeownership, it’s quite difficult to own and eventually maintain the fees for a home, whether it’s land tax or other association fees,” she said in an Instagram message.

While she has multiple income sources to help her sustain the ownership, she said she needs more to live comfortably especially once a family comes into the picture.

Owning a condo unit was much easier a few years ago, when financing for one that costs P2 million to P3 million was effortless, Joey Roi H. Bondoc, a director and head of research at Colliers Philippines, said by telephone.

“The required monthly income for you to be able to get a bank approval was much easier at that time,” he said. “But because of the increase in prices, the hurdles also got higher. That has eventually resulted in young people having a difficult time buying these condominium units.”

The average appraised value of new housing units in the Philippines stood at P86,417 per square meter in the third quarter of 2024, 31% higher than in 2020, according to data from the Philippine central bank.

Jet Yu, founder and chief executive officer at PRIME Philippines, said the property market has undergone a “significant transformation” in the past decades, with more people living in urban areas.

“This shift has driven increased demand for housing in metropolitan areas, pushing property prices higher and reshaping homeownership trends,” he said in an e-mailed reply to questions.

Data from property developer DMCI Homes, Inc. showed that inquiries for rental and rent-to-own properties as well as units for purchase have been increasing steadily over the years.

“As thousands of new households are created each year, the need for housing, whether for lease or purchase, therefore remains strong,” Januel O. Venturanza, DMCI Homes vice-president for marketing, told BusinessWorld.

“The challenge is finding the right home and arrangement — whether for rent, rent-to-own or purchase — that suit the customer’s lifestyle and budget,” he said in an e-mailed response.

Mr. Yu said the interest in homeownership is prevalent among the younger generation.

“More financially independent and willing to take risks, many Millennials view condo ownership as a symbol of success,” he said, referring to people born between the 1980s and the late 1990s. “Similarly, Gen Z — also known as Zoomers — are entering the workforce, bringing with them a preference for condo living.”

Both Millennials and Gen Z — people born from 1997 to 2012 — are “shaping residential condo demand,” Mr. Yu said.

He noted that in recent years, there has been a noticeable shift toward renting, particularly among young professionals and small families. “The increasing popularity of rent-to-own schemes has provided flexibility for those not yet ready to commit to full ownership.”

Central bank data showed that the prices of condominium units fell 9.4% in the third quarter from a year earlier, reversing 10.6% growth in the previous quarter and 8.3% a year ago.

Filipinos preferred single-detached homes and land ownership a few decades ago, Mr. Yu said, but with rising land prices, horizontal residential developments have become scarce, particularly in Metro Manila.

“As a result, vertical living — primarily through condominiums — has become the norm in major commercial business districts and is now widely accepted in key cities across the country,” he said. “With the median age of Filipinos at 25.34 years, a significant portion of the population will continue to drive condo sales and rentals in the coming years.”

Property developers have been cutting the sizes of units to a studio or one-bedroom type to cater to younger buyers, Mr. Yu said.

“Due to affordability issues, renting of homes by families has always been the practice,” Mr. Golez said. “This is especially true for single or starter families. Of course, owning your own home has always been the dream of every Filipino.”

But elevated real estate prices are the main barrier to homeownership.

“In general, the cost of construction, land and financing has grown faster than the salary levels of the population,” Mr. Golez said.

The House of Representatives in February approved on second reading a bill that seeks to give minimum wage workers a P200 daily increase. The Senate approved a counterpart proposal for a P100 daily wage increase for private-sector workers in February last year.

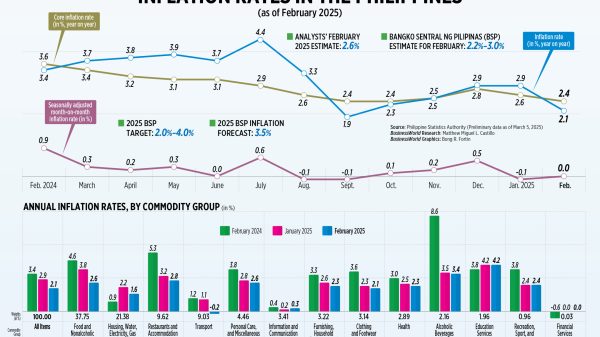

Labor groups have said these proposed increases are not enough amid spiraling prices especially of food.

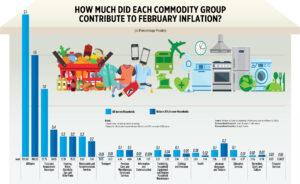

Mr. Golez said inflation’s effect on building materials, labor, construction and financing costs, as well as the growing scarcity of land in Metro Manila would continue to push up property prices.

“There are potential buyers that have been commenting on how they find primary unit property prices are on the high side,” he said. “However, we don’t see a high possibility for developers to lower prices.”

Mr. Yu said elevated property prices are driven by sustained urbanization and steady demand for residential properties, particularly in key cities.

“A young population with a strong motivation to invest in condominiums continues to fuel this demand,” he added.

Condominium prices had been rising more than 10% annually before the COVID-19 pandemic, he pointed out.

“However, in the past year, there were quarters where condo prices slightly dipped,” he said. “Moving forward, price increases are expected to remain moderate, likely within the single-digit percentage range.”

Central bank data showed housing prices nationwide declined 2.3% in the third quarter, the first contraction in more than three years.

‘BUYER’S MARKET’Analysts said homeownership prospects are possible for young professionals despite these hurdles.

“If there is one phrase to describe this market, it’s a buyer’s market at this point, meaning they can really haggle prices,” Mr. Bondoc said.

Colliers data showed that the vacancy in Metro Manila’s secondary market rose to an all-time high of 23.9% in 2024 as Chinese workers left the Philippines after a ban on Philippine offshore gaming operations.

“Now it’s a buyer’s market, and the market dynamics are shifting toward the preferences of young buyers, whether in terms of amenities, in terms of pricing, and even in terms of foreign exchange,” Mr. Bondoc added.

The Bangko Sentral ng Pilipinas (BSP) said real estate loans rose 7.9% in the third quarter of 2024 from 7.2% a quarter earlier and 5% a year ago.

“This shows sustained demand for real estate loans,” it said in an e-mailed statement. “Against this backdrop, property analysts remain positive about the strong demand for real estate loans in the country.”

It expects the continued supply of residential condominiums as developers offer more appealing payment terms for pre-selling and ready-for-occupancy projects.

It added that the industry growth would continue to be driven by urbanization, e-commerce, tourism recovery and evolving work models.

While owning a home may seem like an impossible goal, it is still achievable with the right financial habits, Mr. Venturanza said.

“Start preparing as early as possible, define and tenaciously pursue long-term goals, and do your research,” he said. “Look at developer track records, compare properties and identify which ones offer truly superior overall value.”

Mr. Golez said young professionals should start saving and investing as soon as they can.

“Create an emergency fund of six to 12 months of personal overhead. Do your research on the property you want to purchase and look at other options available to you,” he said.

“The more information you have, the better armed you will be in deciding on your housing investment. Always have the habit of setting aside a portion of what you earn today. You’ll eventually have enough to start buying your own home,” he added.

Mr. Venturanza said a good portion of DMCI customers are below 35 years old.

“Property prices continue to increase, so developers are trying to find ways to address this issue of affordability,” he said.

He added that they are looking to offer flexible and friendlier payment terms.

“Young professionals and families are a significant part of our target market, and we recognize their evolving needs when it comes to housing,” he said.

For example, DMCI Homes offers amenities that cater to younger buyers, such as coworking spaces and fitness facilities.

“Developers need to be more creative and implement out-of-the-box strategies to really attract the young market at this point,” Mr. Bondoc said.

Daisy Isabel Crichton-Stuart, a 23-year-old web developer and entrepreneur based in Manila, sees the opportunities of owning a home even if it’s not an easy task.

“It’s the best time in history to acquire wealth,” she told BusinessWorld. “Everybody has a shot at building their own wealth through many platforms and spaces of opportunity. This can be done through resourcefulness and skill, in addition to plain grit.”

“I have been looking into owning a home recently, but it likely won’t be tomorrow,” she added.