LISTED local media companies are expected to rebound this year, fueled by investments in digital assets and anticipated revenue growth ahead of the 2025 midterm elections.

“The continued growth in online platforms and content consumption allows media companies to reach younger, tech-savvy audiences; investments in digital assets could drive long-term growth,” Globalinks Securities and Stocks, Inc. Head of Sales Trading Toby Allan C. Arce said in a Viber message.

Media companies are projected to see a surge in political advertising ahead of the May elections, he noted.

“Political coverage and election-related programming often lead to higher viewership and engagement,” he added.

“Midterm elections in May 2025 would lead to election-related spending on advertisements for various candidates, in all forms of media,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

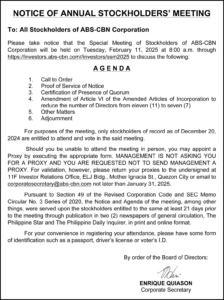

For the first nine months of 2024, ABS-CBN Corp. trimmed its attributable net loss to P2.41 billion from a loss of P3.15 billion in the same period a year earlier.

ABS-CBN recorded a 10.4% drop in consolidated revenue for the period to P12.12 billion due to lower cable TV and broadband revenues.

Meanwhile, GMA Network, Inc.’s attributable net income for the January-to-September period in 2024 declined to P1.41 billion, marking a decrease of 42.9% from the P2.47 billion previously.

The company saw its gross revenue fall by 9.5% to P12.46 billion for the first nine months of 2024 from P13.77 billion in the comparable period a year ago.

Just last week, shares of ABS-CBN surged after a bill seeking to grant the media company a franchise was filed in the House of Representatives.

On Friday, shares in the company closed 2.23% higher at P5.97 each. The company’s shares traded as high as P6.15 apiece intraday. According to BDO Capital and Investment Corp. President Eduardo V. Francisco, the filing of the bill to grant ABS-CBN a franchise would be good for the company’s stock price.

“But I defer to regulators on requirements for renewal and if ABS-CBN still meets it as they are now much smaller in viewership and offerings,” Mr. Francisco added.

However, Mr. Arce noted that the shifting consumer preference toward digital and streaming platforms could pose a significant challenge to media companies’ growth.

“Companies that adapt to digital ad platforms may thrive, while those relying on traditional TV ads could face challenges. The need for high-quality, localized, and engaging content will grow, requiring significant investments,” he said. — Ashley Erika O. Jose